Today we’d like to introduce you to Shavonne Potts

Hi Shavonne, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

I got my first savings account when I was about eight years old, and even at that young age, I learned the importance of money, the value of saving and managing money wisely.

My mother made sure her children understood how money worked, how to manage it and how to make smart decisions. I guess in a way she was my first finance coach. Those lessons she taught me have been woven into the fabric of my life, guiding many of my financial choices. It’s a part of my story that has shaped the type of finance coach I am and how I help others today even if it took me a while to get there.

While I was married, we made some poor financial choices — we spent beyond our means without a savings plan, and money became a constant source of anxiety for me.

After we divorced, I found myself in debt and had to rebuild my financial foundation.

I found a financial coach and with her help I was able to regain control over my finances and work my way out of debt.

I continued to learn as much as I could about finances and shared that knowledge with anyone who would listen.

Entrepreneurship never crossed my mind, but the more I helped family and friends with budgeting, the more it seemed like a natural path for me. Seeing the positive impact my advice had on their finances made me realize I could turn my passion for helping others into something more.

This journey has been incredibly rewarding, letting me empower others to take control of their finances and achieve their goals much like my coach and my mother did for me.

We all face challenges, but looking back would you describe it as a relatively smooth road?

No. It hasn’t always been a smooth road, but what’s the saying, “nothing worth having comes easy.”

Sometimes when you’re pursuing goals, and in the case, creating a business it can be difficult, and at times, it can seem impossible. But throughout this journey I’ve had to remind myself and have been reminded by others who’ve supported me to keep pushing and never give up. The lesson in the journey has been that it won’t always be this way and you will eventually achieve your goals.

One of the biggest struggles has been imposter syndrome. I don’t care what level of business you’re on — just starting out or if you’re a veteran, sometimes you doubt yourself, your skills and in some cases even your successes.

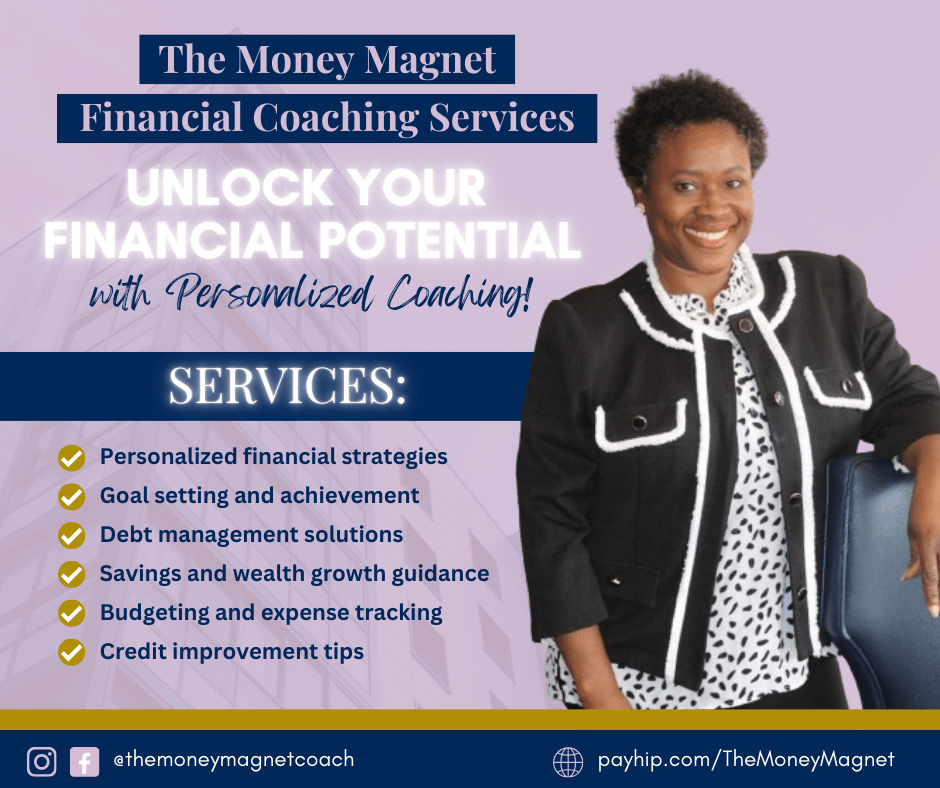

Appreciate you sharing that. What should we know about The Money Magnet Financial Coaching Services?

I’m a solopreneur. I help beginners manage their money by creating personalized spending and savings plans, using systems like automation that fit their lifestyle, and those working to reduce or eliminate debt.

I have a knack for quickly analyzing someone’s financial struggles and instantly coming up with effective solutions. The best way to describe it is I get an immediate download of exactly what they need to do, and I turn that insight into a clear, actionable plan for them to follow.

What makes me different is that I don’t have a degree in finance; my background is in journalism and mass communications. What truly sets me apart in this industry is my firsthand experience with the same struggles my clients face.

I’ve been where they are — struggling to manage money, living paycheck to paycheck, working low-paying jobs, and being a single parent trying to make ends meet. I’ve dealt with debt and learned how to overcome it. My personal journey gives me a unique perspective and genuine empathy, allowing me to connect with my clients and offer practical, relatable advice that I feel truly makes a difference.

I’m most proud of the authentic connection I’ve built with my clients. My brand is all about real, relatable financial coaching from someone who has lived through similar struggles. I take pride in the fact that my clients feel understood and supported because they know I’ve been where they are.

I offer one-to-one coaching that includes weekly milestone meetings where the client receives exclusive action plans to follow. Each client receives an individualized budget spreadsheet and detailed plan for their own money journey.

The coaching includes access to e-books I’ve written including, “Financial Goals: Roadmap to Riches,” and “Crack the Code: Your Credit Report Decoded,” as well as guides including, “10 Money Habits You Didn’t Learn in School,” savings challenges, expense trackers and budget worksheets that I’ve also created.

Is there something surprising that you feel even people who know you might not know about?

In elementary school we were so loud in the cafeteria that the administration staff decided to teach us American Sign Language as a way to keep down the noise. I mastered the ABCs and have surprisingly retained it and some simple words like school, thank you, mother, father, and home.

I used to be able to sign the whole song, “We Fall Down,” by gospel artist Donnie McClurkin, but I’ve forgotten some of the words. I have always felt sign language is such a beautiful language.

Contact Info:

- Website: https://payhip.com/TheMoneyMagnet

- Instagram: https://www.instagram.com/themoneymagnetcoach

- Facebook: https://www.facebook.com/themoneymagnetcoach/

- Twitter: https://x.com/moneymagntcoach