Today we’d like to introduce you to Asia Hill.

Hi Asia, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

I’m originally from Washington, DC, where my mom, Angela Carson Hines, pushed my siblings and I to consistently explore our interests as we grew. As an analytical kid that was good at math, I was drawn to financial literacy programs as a teen. When I say involved, I mean that my mom put my sister and I in as many activities as she could find in the area – we were Girl Scouts in elementary school, we learned ballet at The Washington Ballet for several years, I learned piano and violin in middle school, while my sister learned tennis and lacrosse. By high school, I was well aware of my interests and started going to the “Dollars Make Sense” club a teacher in high school put together. He connected us to other opportunities for financial literacy and expanded on concepts like compound interest, stocks, and bonds that we only briefly covered in math courses.

I was also preparing for college throughout this time. KIPP DC: Key Academy had homerooms based on our teacher’s colleges, we were encouraged to ask them about their college experiences, and the KIPP to College program provided many resources for student and parents to get prepared. School Without Walls High School hosted several college fairs school-wide, inviting our teachers to share their college experiences. They also provided a specific HBCU College Fair every semester, which exposed me to my illustrious alma mater, North Carolina A&T State University.

After hearing about the school in my sophomore year, I told my mom, and by spring break, I was on a bus tour of colleges from Maryland to Georgia (again, that’s just the kind of lady she is).

When I toured the campus, I knew it was where I wanted to be. But, I was still struggling to pick a major. After two summers in the Youth Engagement through Science (YES!) Program the Smithsonian’s National Museum of Natural History, I was convinced that I’d be a scientist. I specifically wanted to study mammals or botany, and I thought I’d be great at the coursework.

Among all of the other transitions and realizations I had freshman year, I also nearly failed Physics and had to reevaluate my choice of major quickly before my first winter break. With my math skills in mind, I went to my academic advisor and asked how I could move to a Math major and possibly minor in Accounting. In my conversation with the accounting department, they let me know that they didn’t offer the minor. This was such a pivotal conversation in my academic career, as I realized that I was still somewhat doubtful in my skill with numbers. I almost felt like I had to be good at something else to make a real career, and the leadership of the accounting department challenged me to let my knowledge speak for itself. So, I changed my major to Accounting – and I never reconsidered my major again.

In addition to student life and leadership opportunities, I thoroughly enjoyed my accounting education. I felt at home with my peers and skilled with the material. I earned an internship with the IRS and two internships with Bank of America while in undergrad, and graduated in 2021 with a full-time offer from Bank of America. I spent July 2021 to July 2023 as a credit analyst in their Global Wealth and Investment Management division, based in Charlotte, North Carolina. While I excelled at the role, I felt unfulfilled and did not see fitting opportunities for my career growth. I grew up interested in entrepreneurship, but once again felt doubt that I could truly make it happen.

After taking on jobs in education administration and retail, I attempted to learn more about the profession directly from a CPA as a contractor during tax season in early 2024. But after onboarding, I was explicitly told that they did not think I had enough expertise to be a seasonal tax preparer, and that my offer would be lowered to receptionist. I was hurt and confused after nearly 6 weeks of training in preparation for the position, just to receive an adjusted offer that would leave me underemployed and missing the skills I had hoped to cultivate.

In that moment, I decided that I’d do it scared. I wanted to feel secure, skillful, and accomplished before I started my own business, but my experiences showed me that the opportunity I was looking for had to be crafted by my own hands. I reached out to the Greensboro Chamber of Commerce and local networking groups I could find online to learn more about entrepreneurship. By June 2024, I had attended entrepreneurial events, spoken one on one with current business owners, and decided on exactly what I wanted to do.

Carson Creative Solutions is an accounting firm for entrepreneurs, self-employed individuals, and creative business founders. As the business’ sole proprietor, I work directly with business owners to record their financial transactions, ensure business and personal finances are properly separated, and discuss the financial trends I see in their business activity. Together, we go beyond basic bookkeeping and reporting to explore opportunities to maximize their profitability – by decreasing expenses, increasing income, assessing what products/projects are profitable, and reviewing what investments owners may need to make in order to grow. With financial sustainability in mind, I help entrepreneurs organize and interpret their financial data and remain tax complaint with annual or quarterly tax filings.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

The road had been mostly smooth, but curved in places I hadn’t expected! Post-graduation, I thought I’d have many opportunities for professional development within Bank of America, and in future career roles. I thought I’d ‘climb the corporate ladder’ and value the stability I expected a W-2 job to provide.

But, the current reality for young people is creating the opportunities and career paths that may not have existed before. Many 2010s and 2020s graduates are facing difficult in salary transparency, stability in their role, and consistent financial strains in housing, feed, transportation, etc.

Alongside the practical and professional challenges, I also struggled mentally. Since coming to North Carolina, I’ve seen my family less and less each year, especially as COVID-19 precautions came and went. I missed the multi-faceted support of my family, but I thought that my independence was proof of my hard work paying off.

But I struggled with loneliness and doubt in my ability to make entrepreneurship work for me long-term and full-time. Over this first year in business, I’ve realized how competent I am and how valuable my services are to my clients. Through the challenges, I’ve developed a deep rooted confidence in my accounting skills and in my business overall.

Thanks for sharing that. So, maybe next you can tell us a bit more about your business?

At Carson Creative Solutions, I provide accounting and tax services for solopreneurs and creatives across the US. My focus is optimizing your business’ profits with thorough financial analysis based on accurate reporting in Quickbooks Online. I provide practical solutions with clarity and care, from basic bookkeeping to annual tax filings.

My unique value is my deeply attentive work directly with individual business founders, and how I work with them to grow their business sustainably. As a solopreneur, I specifically work with other solopreneurs, whom are typically underserved for accounting and tax services. Tax franchises and larger accounting firms tend to be too costly for business owners that are still sole proprietorships, and do not provide the individual attention a growing business needs to thrive.

I am very careful to take on businesses and projects that fit my capacity, and have built relationships with other tax and accounting professionals to make referrals when out of scope projects come my way. I’m deeply proud of my network and my ability to provide solutions for business owners, even when I’m unable to provide the solution myself.

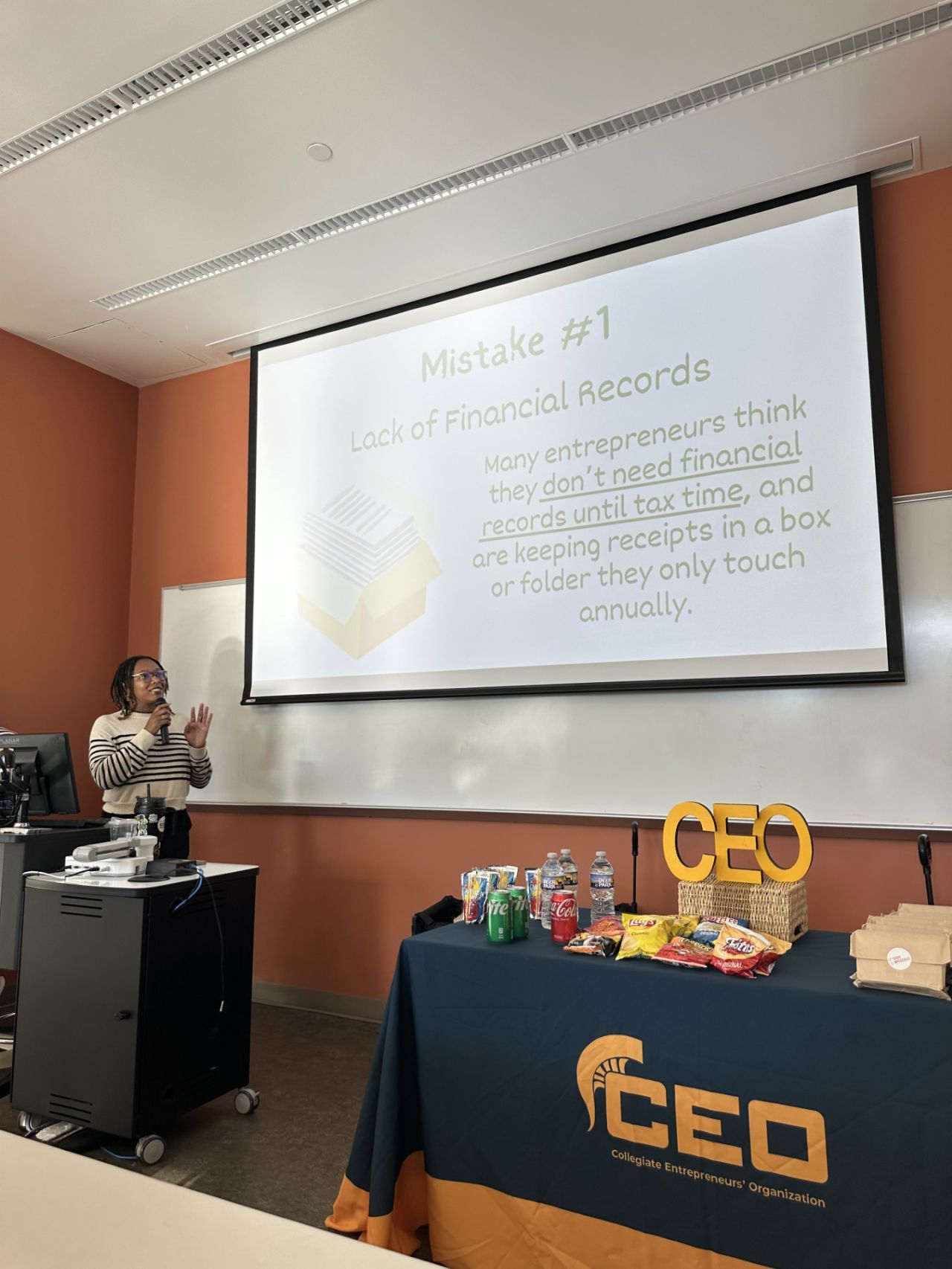

I want readers to know that recording your business transactions matters!! Not just for tax time, but for making sound business decisions throughout the year. If you don’t know what you’re earning and your profits every month, you’re financially running blind in your business. If you can’t maintain those records yourself, it is truly worthwhile to invest in an accounting professional or firm to support you and your business.

In working with clients, I’ve found forgotten subscriptions taking up over $700 a year in a business, I’ve helped owners decide when to purchase equipment, I’ve helped owners prepare financial documents for grants and credit opportunities, and, most of all, I’ve taken away their financial stress by providing clear reports on where their money if coming from and going towards every month.

My business isn’t just about serving my current and potential clients – It’s also about sharing my experience as an entrepreneur myself and the financial challenges and successes I see from within the books of other business owners. I have had the pleasure and honor of working with over 50 small businesses in less than two years in business, and I have seen a LOT; I believe it is my role to provide insight that prevents future business owners from repeating mistakes I’ve already seen entrepreneurs make (including my own).

My business is also rooted in integrity. I am always honest and transparent, and abiding by the principles developed in my profession. Accounting and Tax takes real honesty, attention to detail, and diligence not only in my work, but in how I communicate overall. I’m truly grateful for the trust other business owners have in me, and I don’t take it lightly.

How can people work with you, collaborate with you or support you?

People can work with me by reaching out for a consultation via email (asia@carsoncreativesolutions.com) or my website. During our consultation, I’ll learn more about you and your business, your goals for growth, and your current record keeping system. I work with soloprenuers on a project-basis with an hourly retainer, based on the number of business accounts and cards you have and how many transactions are usually coming thorough every month or year.

People can collaborate with me in many ways! I’ve helped facilitate LaunchCamp with LaunchGreensboro, I’ve been a mentor with the Winston-Salem Women’s Business Center for almost a year, and I’ve been invited to speak to groups like UNC Greensboro’s Collegiate Entrepreneurs Organization (C.E.O.). I’m also happy to collaborate on educational/professional development materials for entrepreneurs, providing practical tips for financial record keeping and analysis.

People can support me by sharing my business with business owners they know! They can also subscribe to my monthly newsletter, where I share timely and actionable tips on business financial management, specifically for soloprenuers.

Pricing:

- $75 per hour

- QuickBooks set-up typically takes 2-4 hours ($150-$300)

- Monthly bookkeeping services typically take up to 5 hours ($375+)

- Annual bookkeeping typically takes 8-10 hours ($600-$750)

- The more transactions there are to record, the longer it will take to update the business’ financial records and provide analysis.

Contact Info:

- Website: https://growth.carsoncreativesolutions.com/home

- LinkedIn: https://www.linkedin.com/in/asiamhill/

- Youtube: https://www.youtube.com/watch?v=wmicef4mJe4&pp=ygUnZ3JlZW5zYm9ybyBjaGFtYmVyIG9mIGNvbW1lcmNlIGlnbml0aW9u0gcJCQcKAYcqIYzv

- Yelp: https://www.yelp.com/biz/carson-creative-solutions-greensboro